Blog

Navigating Retirement Pitfalls

Much is written about the classic financial mistakes that plague start-ups, family businesses, corporations, and charities. Some classic financial missteps have been known to plague retirees, too. Calling them "missteps" may be a bit harsh, as not all of them...

Does Your Portfolio Fit Your Retirement Lifestyle?

Most portfolios are constructed based on an individual's investment objective, risk tolerance, and time horizon. Using these inputs and sophisticated portfolio-optimization calculations, most investors can feel confident that they own a well-diversified portfolio,...

Preparing for the Expected

As Teddy Roosevelt once observed, "Old age is like everything else. To make a success of it, you've got to start young." The challenges seniors have met throughout their lives have made them wiser and stronger, preparing them for the unique challenges that come with...

The Value of Insuring Against Life’s Risks

Did you know that... Fifty-seven percent of American workers have no private short-term disability insurance.1,2 Sixty-five percent of working people in the U.S. lack private long-term disability coverage.1,2 Forty-eight percent of Americans have no life insurance.3,4...

Retiring Wild: National Parks and You

For many older adults, finding time to experience nature can be one of the greatest pleasures in retirement. And what better place to take in America's splendor than one of our over 400 National Park Service sites? For over a century, generations of retirees have...

Help With Estate Strategies

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and 813 Financial are...

Help With Retirement Preparation

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and 813 Financial are...

Help With Investment Approaches

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and 813 Financial are...

Help With Cash Management

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and 813 Financial are...

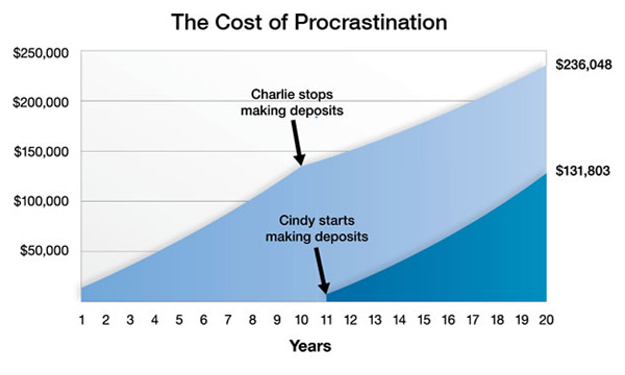

The Cost of Procrastination

Some of us share a common experience. You're driving along when a police cruiser pulls up behind you with its lights flashing. You pull over, the officer gets out, and your heart drops. “Are you aware the registration on your car has expired?” You've experienced one...