Blog

Orchestrating Your Retirement Accounts

An orchestra is merely a collection of instruments, each creating a unique sound. It is only when a conductor leads them that they produce the beautiful music imagined by the composer. The same can be said about your retirement strategy. The typical retirement...

Getting a Head Start on College Savings

The U.S. Department of Agriculture estimates the cost of raising a child to the age of 17 for a middle-income family will be about $285,000. That's approaching the median value of a new home in the U.S.1,2 If you want to add the cost of education to that number, you...

Estate Management Checklist

Do you have a will? A will enables you to specify who you want to inherit your property and other assets. A will also enables you to name a guardian for your minor children. Do you have healthcare documents in place? Healthcare documents spell out your wishes for...

Navigating Retirement Pitfalls

Much is written about the classic financial mistakes that plague start-ups, family businesses, corporations, and charities. Some classic financial missteps have been known to plague retirees, too. Calling them “missteps” may be a bit harsh, as not all of them...

Be totally forthcoming with your financial professional

Being totally forthcoming about your finances is important when speaking to a financial professional. That means no false modesty or bogus confidence about your situation. Talk about the things that matter to you, the things that concern you, and above all, ask frank...

Good Times and Bad

In good times and bad, your financial professional is there to help. If you need someone to help you navigate what’s ahead and help you protect your finances, you can turn to your financial professional. Securities offered through Registered Representatives of...

Scoop on your work life

Your financial professional should get the scoop about your work life. Whether you get that big raise, start a new job or get a new title, or start your own business, your financial pro needs to be in the loop. Securities offered through Registered...

Big News

Who’s the first person you tell big news to? Your spouse? Your family? Put your financial professional near the top of your list. They need to know about the big transitions you make, so they can help you adjust your strategy accordingly. Securities offered...

Goals and Dreams

We all have goals and dreams and things we’d like to pursue. But how can your financial professional be of any help if they don’t know what they are? Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer,...

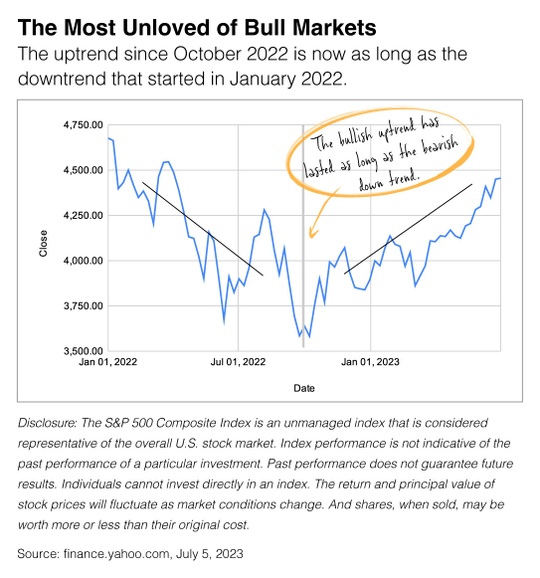

Wasn’t There Supposed To Be A Recession?

In advance of 2023, the recession drum beats were so loud it was deafening. Market pundits warned that as the Fed raised interest rates, it was just a matter of time before the economy entered a recession. But it’s July now, and so far, no recession. It appears that...